Market Recap

Gold prices fell sharply on Tuesday as the US dollar hit a three-month high and traders scaled back expectations of another Fed rate cut in December. The ongoing US government shutdown, now the longest in history, further fueled market caution and left investors looking to alternative data sources for economic signals. Meanwhile, oil prices slipped, pressured by a stronger dollar and growing concerns about global demand.

Gold

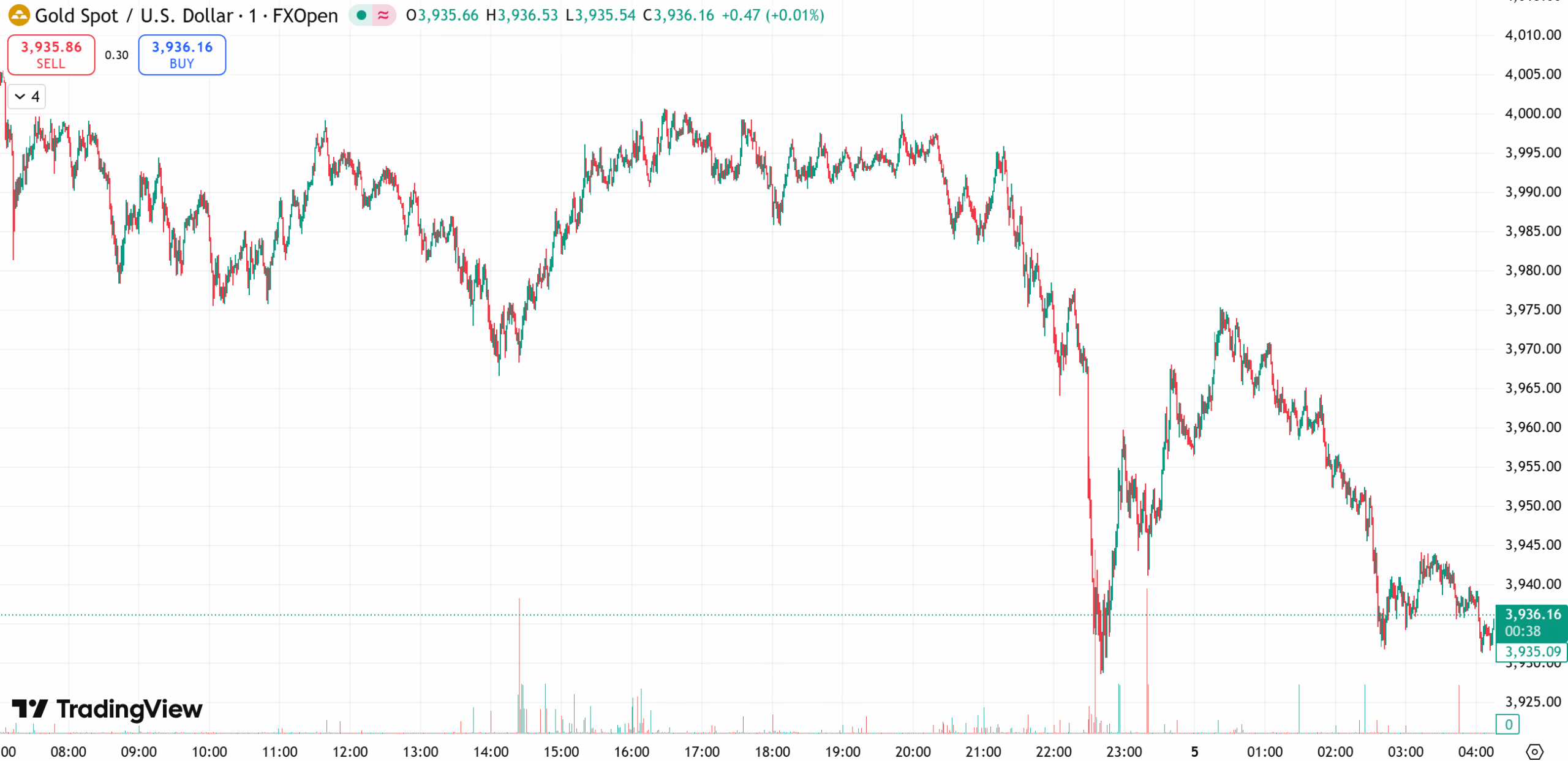

Spot gold slid close to 2%, settling near $3,940 per ounce, while US December gold futures fell 1.3% to $3,960.50. The dollar index’s climb was the main driver behind the decline, as traders pared bets that the Fed would deliver another rate cut before year-end.

Fed Chair Jerome Powell’s recent comments hinting that last week’s rate cut may be the final one of 2025 also weighed on sentiment. Market-implied odds for a December cut dropped from over 90% to about 71% in just a week.

With the government shutdown halting key economic reports, traders are now watching the ADP private employment data for clues on economic health. Analysts note the absence of official data is leaving markets directionless in the short term.

Technical Outlook:

Gold remains in a weak consolidation phase. The $4,000 level continues to act as a strong resistance zone after multiple failed retests, while $3,915–$3,885 forms key support. The 4-hour chart shows bearish momentum dominating, though a rebound from near-term lows remains possible if buyers defend support levels.

Trading Plan:

- Strategy: Sell on rebounds, buy near dips.

- Resistance: $3,970–$4,000

- Support: $3,910–$3,880

Oil

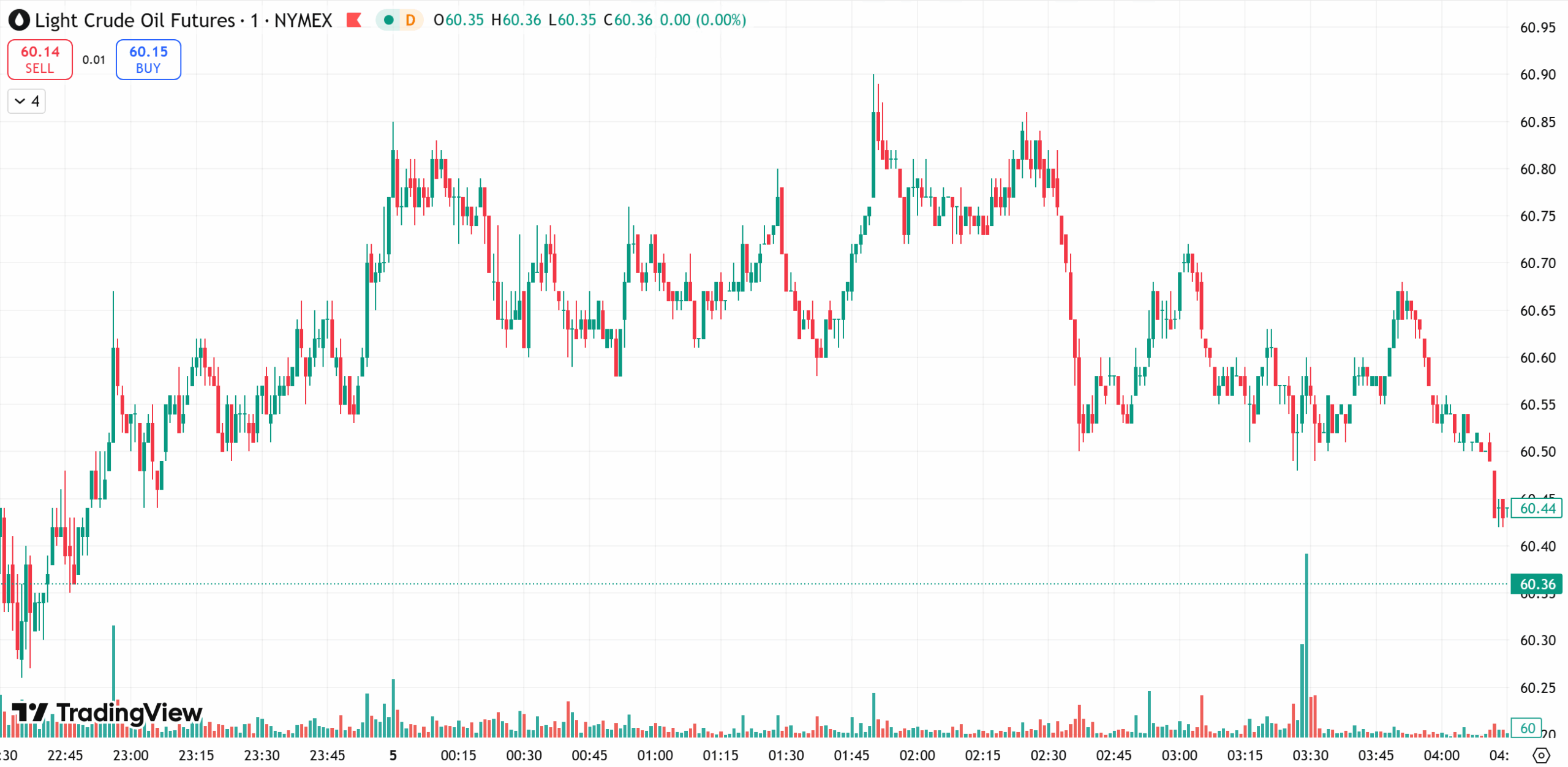

Oil prices declined as a stronger dollar and weak manufacturing data stoked concerns about future demand. Brent crude fell 0.7% to $64.44 per barrel, while WTI lost 0.8%, closing at $60.56.

Analysts pointed to a combination of a firm dollar, the US shutdown, and Wall Street weakness as drivers of the day’s risk-off sentiment. On the supply side, OPEC+ confirmed plans to pause output hikes in Q1 2026, signaling growing caution about oversupply.

Technical Outlook:

Oil continues to trade within a broad sideways range, showing short-term weakness after failing to extend gains. The MACD indicator signals waning bearish pressure, while overall momentum remains neutral to mildly bullish in the medium term.

Trading Plan:

- Strategy: Buy on dips, sell near resistance.

- Resistance: $61.5–$62.5

- Support: $59.0–$58.0

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the rapid and unpredictable fluctuation in the value and prices of these underlying financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.

Disclaimer

This information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction.

D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.